Limited Time Offer: Save up to 80% on Your Debt

Become Debt-Free in Half the Time

Join Thousands of Canadians who have reduced their debt by an average of 60% and regained financial freedom.

Get Your Free Debt Assessment Today

See how much you could save in just 2 minutes

No Credit Check

100% Free Consultation

No Obligation

Based on 500+ verified reviews

4.9/5

Licensed & Regulated

Government approved

Thousands of Clients

Helped across Canada

98% Satisfaction

Client success rate

Our Unique Approach

Why Choose UnDebt?

We offer comprehensive debt relief solutions tailored to your unique financial situation.

Debt Reduction

Reduce your debt by up to 80% with our proven strategies

Lower Monthly Payments

Consolidate your debts into one affordable monthly payment

Peace of Mind

End collection calls and reduce financial stress

Expert Support

Our team of professionals is with you every step of the way

Real Results

See What Our Clients Have Achieved

These are typical results our clients experience with our debt relief programs.

60%

Average debt reduction

Most clients see 40-80% of their debt eliminated

50%

Lower monthly payments

Consolidate multiple payments into one affordable payment

3-5 Years

Faster debt freedom

Become debt-free in half the time of minimum payments

See Your Savings

Calculate Your Potential Savings

See how much you could save with UnDebt’s debt relief programs. Our calculator gives you an estimate of your potential savings.

Debt Savings Calculator

See how much you could save with UnDebt's debt relief program

Standard Repayment

- Time to pay off:

- 0 months

- Total interest:

- $0

- Total payment:

- $0

UnDebt Program

- Time to pay off:

- 0 months

- Total interest:

- $0

- Total payment:

- $0

Your Potential Savings:

With UnDebt's debt relief program

Results are estimates. Actual savings may vary based on individual circumstances.

Want a personalized assessment? Our debt specialists can provide a detailed analysis of your situation.

Benefits

You Have Nothing To Lose Other Than Your Debt

Our debt relief programs are designed to help you maintain your lifestyle while eliminating your debt burden.

Keep Your Car

Keep Your Home

Keep Your RRSP's

We Handle Creditors You Owe

Single, Good Monthly Repayment

Ready to get started?

Take the first step toward financial freedom today.

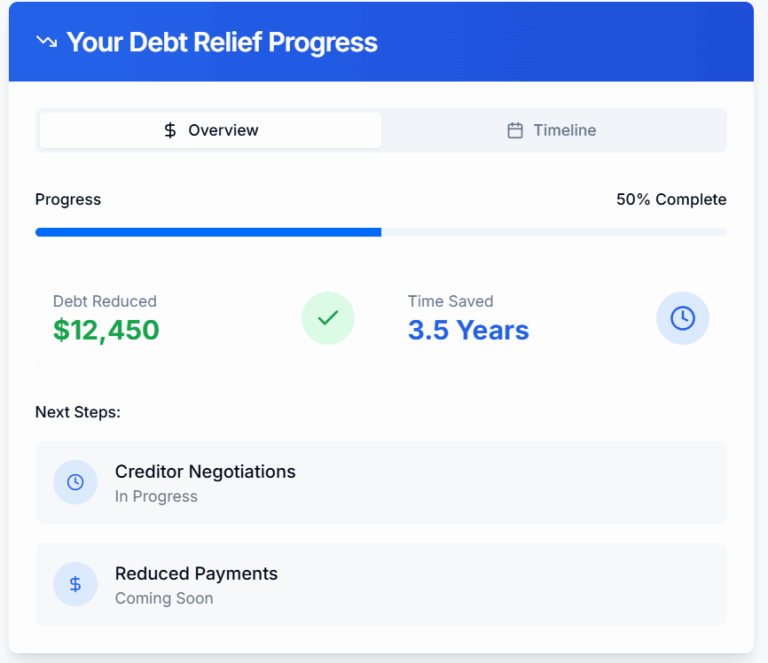

Your Journey

Track Your Debt Relief Journey (Coming Soon)

Our easy-to-use dashboard helps you monitor your progress toward becoming debt-free.

Success Stories

Thousands Of Canadians Have Achieved Freedom With UnDebt

Don’t just take our word for it. Hear from our clients who have successfully overcome their debt challenges.

"The collection calls were driving me crazy. UnDebt stepped in, negotiated with my creditors, and now I have one affordable monthly payment. The peace of mind is priceless."

Join thousands of Canadians who have already taken control of their debt.

Proven Results You Can Trust

Our track record speaks for itself. Here’s what we’ve accomplished for Canadians like you.

For Canadians across the country

Based on exit surveys

Helping Canadians become debt-free

Simple Process

How Our Program Works

Our streamlined process makes debt relief simple and stress-free.

Free Debt Assessment

Complete our simple application to get a personalized debt relief plan

Lower monthly payments

Consolidate multiple payments into one affordable payment

Faster debt freedom

Become debt-free in half the time of minimum payments

Ready to take the first step toward financial freedom?

Financial Insights

Latest from Our Blog

Expert advice and insights to help you navigate your debt relief journey and improve your financial health.

How a Bankruptcy Works in Canada in 2025

Introduction Photo by Andrea Piacquadio on Pexels Facing financial difficulties can be overwhelming, but understanding

How a Debt Relief Works in 2025

Introduction Photo by RDNE Stock project on Pexels Debt relief has evolved significantly by 2025,

How a HELOC works

Introduction Photo by Anastasiya Gepp on Pexels A Home Equity Line of Credit (HELOC)

Nationwide Coverage

Areas We Service

We provide debt relief services to Canadians across the country.

Ontario

- Toronto

- Ottawa

- Mississauga

- Hamilton

- London

British Columbia

- Vancouver

- Victoria

- Kelowna

- Surrey

- Burnaby

Alberta

- Calgary

- Edmonton

- Red Deer

- Lethbridge

- Fort McMurray

Saskachtewan

- Regina

- Saskatoon

- Prince Albert

- Moose Jaw

- Swift Current

Manitoba

- Winnipeg

- Brandon

- Thompson

- Steinbach

- Portage la Prairie

Nova Scotia

- Halifax

- Sydney

- Dartmouth

- Truro

- New Glasgow

New Brunswick

- Fredericton

- Saint John

- Moncton

- Dieppe

- Miramichi

Newfoundland

- St. John's

- Mount Pearl

- Corner Brook

- Grand Falls-Windsor

- Gander

Prince Edward Island

- Charlottetown

- Summerside

- Stratford

- Cornwall

- Montague

Yukon

- Whitehorse

- Dawson City

- Watson Lake

- Haines Junction

- Faro

Northwest Territories

- Yellowknife

- Hay River

- Inuvik

- Fort Smith

- Norman Wells

Nunavut

- Iqaluit

- Rankin Inlet

- Arviat

- Baker Lake

- Cambridge Bay

Don’t see your city? We serve all locations across Canada except Quebec.

Our Promise

What To Expect From UnDebt

Our dedicated team will work with you every step of the way to ensure you understand the process and feel confident in your financial future. We provide personalized solutions tailored to your specific situation.

With UnDebt, you can expect transparency, support, and results. Our proven methods have helped thousands of Canadians regain control of their finances and live debt-free.

Personalized Solutions

100%

Transparent Process

Always

Expert Guidance

Guaranteed

Ongoing Support

24/7

Get Started

Take The First Step Toward Financial Freedom

Complete the form below to get your free debt assessment worth $250 – no obligation.

Your Free Assessment Includes:

- Complete analysis of your current debt situation

- Personalized debt relief options explained in detail

- Potential savings calculation and timeline to debt freedom

- Expert advice from licensed debt relief specialists

- No obligation - completely free consultation

Why Canadians Trust UnDebt:

Licensed & Regulated

Government approved

Thousands of Clients

Helped across Canada

A+ BBB Rating

Accredited business

4.9/5 Rating

From verified reviews

Get Your Free Debt Assessment

Your information is secure and confidential

Common Questions

Frequently Asked Questions

Find answers to the most common questions about our debt relief services.

How does UnDebt help with my debt?

Will debt relief affect my credit score?

How long does the debt relief process take?

What types of debt can UnDebt help with?

Is there a minimum amount of debt required?

How much does UnDebt's service cost?

Can I keep my assets like my home and car?

Will collection calls stop when I join UnDebt's program?

Do I qualify for debt relief?

Can I include tax debt in my debt relief program?

How do I get started with UnDebt?

What happens to my credit after completing the program?

Still have questions? We’re here to help.

Ready To Take Control Of Your Financial Future?

Don’t wait any longer to achieve financial freedom. Our debt relief specialists are ready to help you create a personalized plan to eliminate your debt and regain control of your finances.

Your Free Assessment Includes:

- Personalized debt relief options

- Potential savings calculation

- Timeline to becoming debt-free

Canadian Debt Relief Solutions

UnDebt is a leading provider of debt relief solutions for Canadians struggling with financial challenges. Our comprehensive approach to debt management helps individuals and families across Canada regain control of their finances and work toward a debt-free future.

With offices serving major cities including Toronto, Vancouver, Calgary, Montreal, and Ottawa, our team of financial experts provides personalized debt relief strategies tailored to each client’s unique situation. Whether you’re dealing with credit card debt, personal loans, payday loans, or tax debt, our solutions can help you reduce your debt burden and monthly payments.

Our debt relief services include debt consolidation, consumer proposals, credit counseling, and financial planning. Through these programs, many of our clients have reduced their debt by up to 80% and eliminated their debt years sooner than they would have through minimum payments alone.

If you’re feeling overwhelmed by debt, contact UnDebt today for a free, no-obligation consultation. Our debt relief specialists will analyze your financial situation and recommend the best path forward to help you achieve financial freedom.